Framework and use of the accounting plan

The BAS Accounting Plan framework is based on the formats for income statements and balance sheets in the Annual Accounts Act and the supplementary rules from the Swedish Accounting Standards Board. This is a great advantage as regards understanding how the account structure is linked to the company’s annual closing/annual report. The framework of the accounting plan also makes it easier to follow a business transaction from registration to its final place in the balance sheet and income statement.

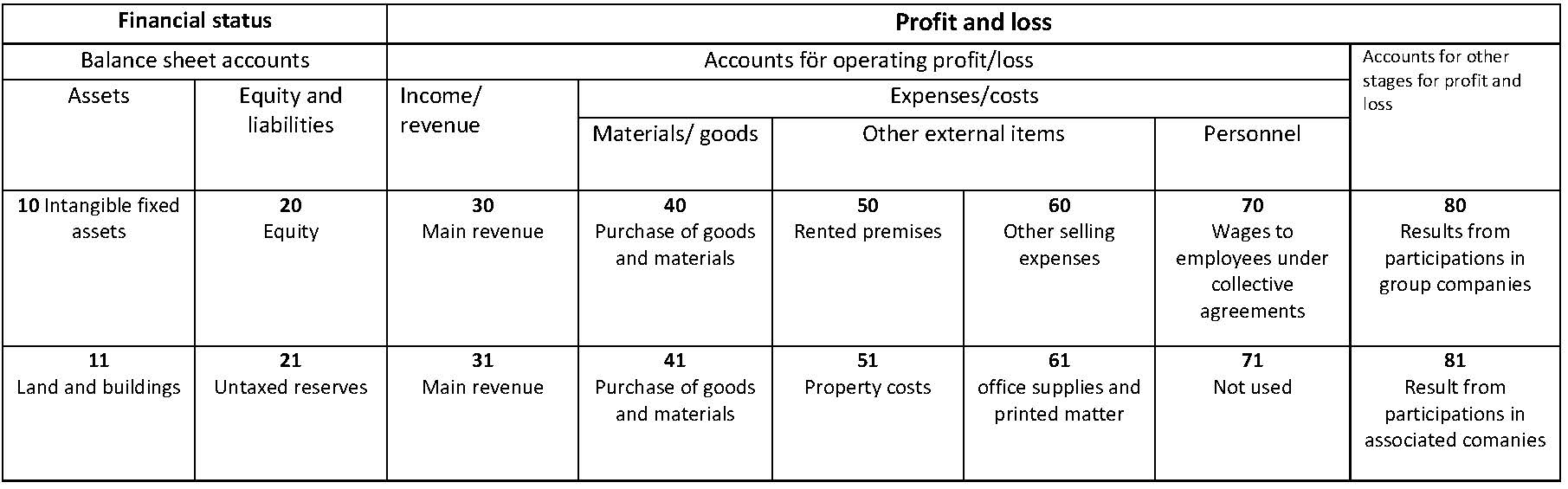

Basic schedule of the accounting plan

The BAS Accounting Plan includes 8 account classes. Assets are recorded in account class 1 and liabilities and equity are recorded in account class 2. Income and expenses are recorded in account classes 3-8.

The accounting plan follows the income statement classified by nature of expense.

| Balance sheet accounts | |

| Account class 1 | Assets |

| Account class 2 | Equity and liabilities |

| Profit and loss |

|

| Account class 3 | Income/revenue |

| Account class 4 | Material/goods |

| Account class 5-6 | Other external items |

| Account class 7 | Personnel |

| Account class 8 | Accounts for other stages om profit and loss calculation |

The accounting plan also includes class 0 for recording supplementary information, statistics etc. This is information that is not classified as accounting information and is therefore outside the formal accounting plan.

The accounting plan also has an account class 9 for management accounting. This is also outside the formal accounting plan. However, it is common for some form of object accounting to be used instead of account class 9. Object accounting means that the company, in addition to the four digits of the BAS Accounting Plan, can specify digits corresponding to a number of object types, such as department, product or project.

Accounting Plan structure

The digits in the account numbers refer to the position of the account in the BAS Accounting Plan.

6 Other external operating expenses/costs — Account class

62 Telecommunications and postal services — Account group

6200 Telecommunications and postal services — Control account

6210 Telecommunications — Main account

6211 Fixed telephony — Sub-account

An account number contains four digits. The first digit in the account number indicates the account class and the two first digits indicate the account group.

If an account number ends in two noughts, such as 6200, it is a control account. In the example above, this means that only one account is used for all transactions belonging to the account group 62 Telecommunications and postal services.

If the account number ends in just one nought it is a main account. There may be several main accounts in an account group. The account group 62 contains, for example, accounts 6210, 6230 and 6250.

An account number ending in a digit from 1–9 is a sub-account. For the main account 6210 the company can use the sub-accounts 6211 Fixed telephony and 6212 Mobile telephony.

Alternative 1

6200 Telecommunication and postal service

Only one account is used for the entire account group (controll account = 00 as third and forth digits)

Alternative 2

6210 Telecommunication

6230 Data communication

6250 Postal service

One, two or more accounts are used as main accounts (0 as the fourth digit)

Alternative 3

6210 Telecommunication

6211 Fixed telephony

6212 Mobile telephony

6213 Paging

6214 Fax

6215 Telex

All of the accounts in the chart of accounts are used. These may be devided into sub- accounts (6211, 6212 etc.) The subaccounts are then used instead of the main account (6210)

The BAS Accounting Plan’s divisions into account classes (Click for larger image)